RBI Concepts - Return on Net Assets (RONA)

Register

Nothing is scheduled at this time.

Request more information about when this course will be scheduled or inquire about our on-site training.

Overview

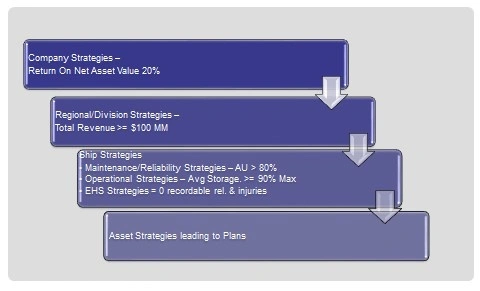

How does your mechanical integrity program help your company achieve your corporate goals for dividends and profits? The answer is to achieve the required return on net assets (RONA).

RONA is not that far removed from the boardroom. We have heard many conversations like this one:

President: "We need 25 percent RONA to meet our objectives for dividends and profit."

CFO: "That translates into a Net Income of $200M for the company's four regions, A, B, C, and D."

Director, Region A: "Therefore my region needs to contribute 33% of that number since we have 33% of the total asset value and work capital for the company which is $66.7M next year."

Somewhere in that equation is a component of share price, book value, dividends and of course bonuses paid out to managers for achieving their targets. We will take you there - one step at a time - and demonstrate the importance of being able to measure the performance of your program as well as the performance of those managing your program.

Topics

- What is RONA and how is it calculated?

- How does RONA translate into Net Income?

- How does your total asset value and working capital translate into achieving your contribution to RONA?

-

What is Asset Utilization (AU) and how does it translate into your

- Maintenance Strategies,

- Operational Strategies, and

- Acceptable Risk Strategy?

-

How do your KPIs measure your ability to achieve this goal, and more specifically:

- The need to meet your Fixed Asset Strategy inspection due dates and confidence levels,

- OEE for your rotating equipment, and

- Instruments and Controls target percentage of spurious trips?

Related Services

AOC has delivered thousands of sustainable Risk Based Inspection (RBI) programs earning the trust of owner operators.

Innovative technology that allows quick, efficient extraction of data into a knowledge-centric world

An interdependent assessment of your people, process, and technologies for a confident path forward

Related Tools

Create mechanical integrity (MI) program value rather than it being seen as a necessary cost to minimize.

How well do you know RBI? Take this short quiz to test your knowledge of the API 580 risk-based inspection (RBI) work process.

Related Training

How does one of the largest chemical manufacturers measure the value of their RBI program?

Developing the value proposition and business case for an RBI program

How does your AI program meet your RONA goals?

A high level overview introducing Mechanical Integrity and Risk Based Inspection

What impact does Risk Based Inspection (RBI) have on my organization?

Related Knowledge

Safety-first organizations consistently outperform on reliability when priorities are truly enforced, not just stated.

Don’t let your RBI program become a "paperwork exercise." Learn how to distinguish between a qualified technical partner and a software-only contractor to ensure true operational safety.

How AOC's new AI solution cuts data collection time for Risk-Based Inspection (RBI) projects by automatically extracting and normalizing data from historical engineering documents, achieving very high accuracy and reducing costs.

Budget tight? Some Risk-Based Inspection (RBI) risks are too critical to delay. Learn the top 3 RBI risks that can't wait for a budget rebound.

What does a strong refining culture actually look like in practice? Explore seven key attributes, from technical authority to management presence, that transform culture into a powerful risk-control system.

Rate reduction on new projects to support the industry during the current extended downturn.

What are the hidden benefits of implementing Risk Based Inspection?

A look at how the financial sector's concept of Asset Value Management can be applied to the petrochemical industry.

A look at how RBI adds value whether you are just starting out or transitioning from a traditional methodology.

Organizations that follow the spirit of risk-based inspection rather than its minimum requirements use a definable, structured, auditable process to confirm that an alternate inspection technique provides equal or better risk reduction than a baseline method.

Lunch and Learn Inquiry

For more information about this course or to inquire about a customized version of this course hosted in-house at our Houston, Texas location or on-site at a location convenient to you, please complete the form below.